The Affordable Care Act can have a major impact of when you retire and claim Social Security benefits. As you plan your retirement budget, you’ll need to consider medical insurance and health care costs. For many older Americans next to housing, healthcare related costs are the largest expense.

Many individuals will pay lower health insurance premiums due to the amount of their Modified Adjusted Gross Income (MAGI). This creates a new strategy for maximizing Social Security benefits. By not taking early Social Security retirement benefits you can often significantly lower your MAGI and qualify for lower health care premiums.

Here is an example of how this works for a Silver Plan:

Couple age 62, MAGI of $60,000, non-tobacco users:

- Household income in 2014: 387 percent of the poverty level

- Unsubsidized medical insurance premium in 2014: $14,567

- Receives a government tax credit subsidy of up to: $8,867 (about 61 percent of the medical insurance premium)

- Net amount of 2014 premium $5,700

Same couple, age 62 MAGI of $63,000, non-tobacco users:

- Household income in 2014: 406 percent of the poverty level

- Unsubsidized medical insurance premium in 2014: $14,567

- Eligibility for subsidy: No

- Net amount of 2014 premium $14,567

In other words, if this couple increases their income by just $3,000 annually they will lose the subsidy and pay $8,867 more per year (that’s $739 per month) for medical insurance. This is a good reason to wait until you are eligible for Medicare, then take Social Security.

Calculating Where You Stand

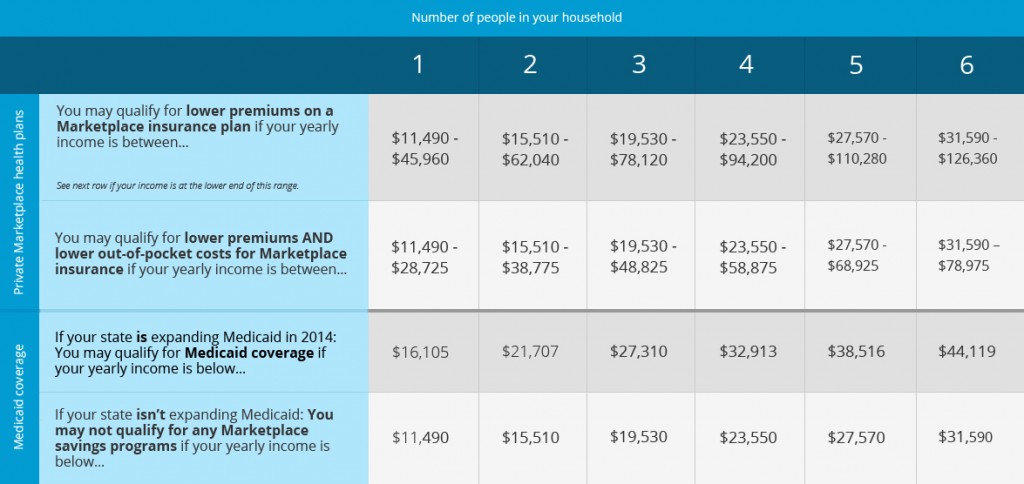

The MAGI is generally your adjusted gross income plus any tax-exempt Social Security, Social Security Disability (but not SSI), interest or foreign income. Once you have determined your estimated 2014 household income and household size refer to the chart below from www.healthcare.gov.

Choose the column for your household size. The column on the left shows income levels that qualify for lower costs on premiums and out-of-pocket costs for private health insurance, and for low-cost health care through Medicaid. Additionally, there is an online calculator at the Kaiser Foundation Web site located at http://kff.org/interactive/subsidy-calculator/ .