Find out if you are living in a state that makes you eligible for same-sex spousal or survivor Social Security benefits

The proposed 2016 President Obama budget (www.bloomberg.com/news/) includes a major change to Social Security that would allow same-sex couples to receive spousal benefits if they live in states that do not recognize same-sex marriages. The Obama proposal could cost as much as $14 billion over a ten-year period and has to be passed by a Republican-led Congress.

Public sentiment towards same-sex marriage has rapidly changed. According to the Pew Research Center (www.pewresearch.org) 52 percent of Americans are in favor of gay marriages (in 2004 about 31 percent of Americans were in favor of same-sex marriages).

Today the Social Security Administration (SSA) recognizes Same-Sex Marriages in some states (for details see www.ssa.gov). The following shows how easy or difficult claiming spousal or survivor benefits will be for same-sex couples. Here are a few examples of how spousal benefits vary by state:

1. California recognizes same-sex marriage as valid from June 16, 2008 to present. If a claimant married a Social Security eligible worker in California on October 2008 and the worker dies while living in California on October 30, 2011. The SSA would recognize the marriage has having a duration of three-years when calculating survivor and / or lump sum death benefits.

2. Two individuals enter into a same-sex marriage in Michigan on March 21, 2014. The couple then move to Massachusetts and establish their home. While in Massachusetts one partner applies for spousal retirement benefits based on the other partners’ work record. The SSA will determine that the marriage was valid in Michigan and recognized by Massachusetts at the time of application. The SSA will recognize the marriage for the purposes of spousal benefits. (SSA Sources: GN00210.002 Same-Sex Marriage-Determining Marital Status for Title II and Medicate Benefits and EM-14052 Changes to Policy Involving Same-Sex Marriage in Michigan One-Time-Only instruction)

3. In Indiana, a claim for same-sex marriage survivor benefits for an eligible worker who died between June 28, 2014 and October 5, 2014 must be sent via Email to the SSA with a subject line: “Windsor Claim Hold- Indiana” and the SSN of the deceased worker in the body of the message.

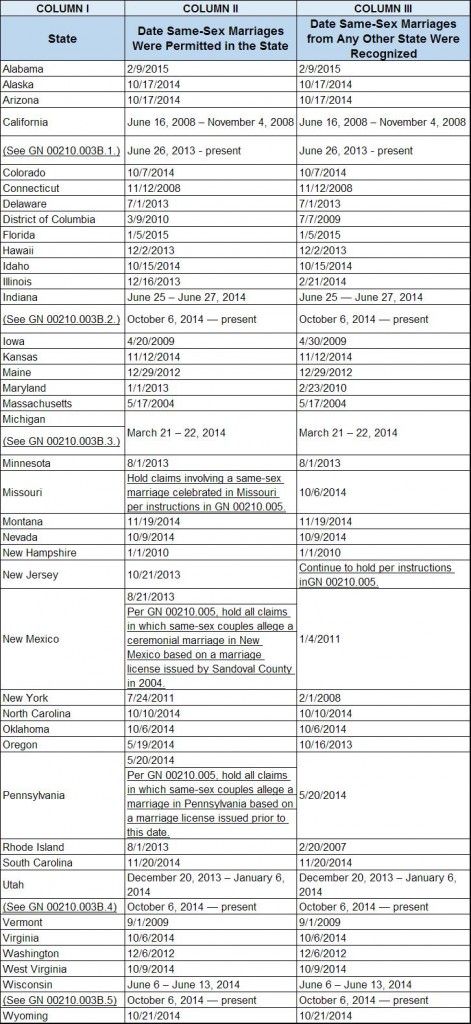

For more information see the following chart from the SSA (http://www.ssa.gov). This graph indicates which states have laws permitting same-sex marriage (Column I), the date when the state listed permitted same-sex marriages (Column II) and the dates states recognized same-sex marriages from other states (III). This chart is useful for gaining an understanding of eligibility for same-sex spousal or survivor Social Security benefits. For information about your individual application status check with your local Social Security Representative.