Distribution Adjustments Based on the Family Maximum Benefit

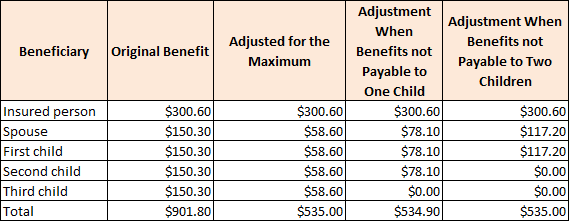

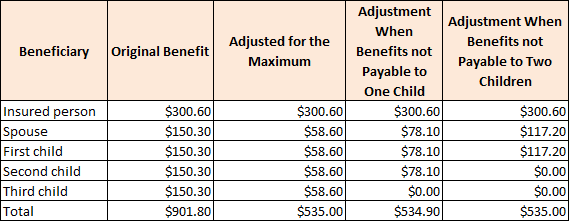

In some situations the number of dependents claiming benefits on an earner’s record exceeds the Family Maximum Benefit (FMB) amount. For example, in the table above the earner’s full benefit amount is $300.60 and the FMB is $535.10. Therefore the earner’s dependents will have to divide $234.50 evenly between themselves. Note: The ex-spouse is not included in the FMB calculation and receives 50 percent of the earner’s benefit ($150.30).

The table above illustrates how the earner’s benefit is not reduced due to others claiming benefits on his or her work record. The second column shows the initial entitlement of each family member. The third column shows the redistribution of benefits due to the Family Maximum Benefit Calculation. The fourth column shows the readjustment when benefits are not paid to one child. The last column illustrates the readjustment when benefits are not paid to two children.

SOURCE: Social Security Administration (www.ssa.gov), 2012.

About ksindell

Kathleen Sindell, Ph.D. is the author of numerous academic, popular, and professional finance articles, Web sites, proposals, and books. This includes the bestselling reference book, "Investing Online for Dummies, Eds 1-5" (listed for two consecutive years on the Wall Street Journal's Bestselling Business Book List). Her most recent book "Social Security: Maximize your Benefits" has been listed in Amazon's Top 100 Bestselling Retirement Planning Books. It is important to note that "Social Security: Maximize Your Benefits, 2nd Edition" was just released.

Sindell has an in-depth understanding of the financial services industry and has held Series 7, 63, and 65 licenses. Dr. Sindell is regularly tapped as a financial services expert on ABC World News, The Nightly Business Report, and at popular online and print outlets. Kathleen Sindell, Ph.D. is a member of the Board of Directors for the Financial Planning Association, National Capital Area (FPA NCA), is on the Editorial Advisory Panel of the Journal of Financial Planning, and is Co-Chair of the Metro Washington Financial Planning Day. Sindell is a Course Chair II, CFP Program Academic Officer, and adjunct full-professor at the University of Maryland, UMUC, School of Undergraduate Studies.

Contact Information: ksindell@kathleensindell.com or 703-299-1700

Pingback: Using Family Benefits to Fund Your Early Retirement .. | kathleensindell.com