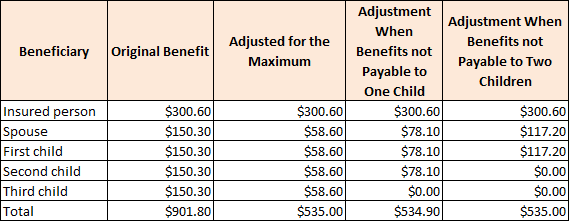

Distribution Adjustments Based on the Family Maximum Benefit

In some situations the number of dependents claiming benefits on an earner’s record exceeds the Family Maximum Benefit (FMB) amount. For example, in the table above the earner’s full benefit amount is $300.60 and the FMB is $535.10. Therefore the earner’s dependents will have to divide $234.50 evenly between themselves. Note: The ex-spouse is not included in the FMB calculation and receives 50 percent of the earner’s benefit ($150.30).

The table above illustrates how the earner’s benefit is not reduced due to others claiming benefits on his or her work record. The second column shows the initial entitlement of each family member. The third column shows the redistribution of benefits due to the Family Maximum Benefit Calculation. The fourth column shows the readjustment when benefits are not paid to one child. The last column illustrates the readjustment when benefits are not paid to two children.

SOURCE: Social Security Administration (www.ssa.gov), 2012.