Each year the Social Security Administration (SSA.gov) publishes Old Age, Survivors, Disability Insurance Benefits and Supplemental Security Income program rates and limits. Below is a verbatim review of the 2018 information provided by the SSA.

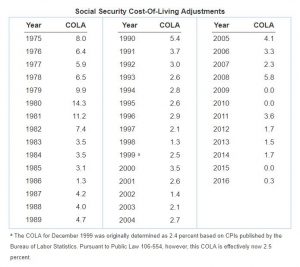

The important news for Social Security retirement recipients is the 2.0% Cost of Living Adjustment (COLA). The 2018 COLA increase (effective January 2018) is the highest pay hike in Social Security benefits in years.

Tax Rates

-Social Security Tax Rate for Employer and Employee: 6.20%

-Medicare Tax Rate for Employer and Employee: 1.45%

-Total Social Security and Medicare Tax Rate: 15.3%

Taxable Earnings

-Maximum Taxable Earnings for Social Security: $128,700

-Maximum Taxable Earnings for Medicare Hospital Insurance: No limit

Quarter of Coverage

-Earnings Required for One Quarter of Coverage Work Credit: $1,320

-Earnings Required for Maximum of Four Credits a Year: $5,280

Exempt Earnings

-Exempt Earnings Amount Under Full Retirement Age: $17,040

-Exempt Earnings Amount Before Reaching Full Retirement Age: $45,360

-Exempt Earnings Reaching Full Retirement Age: No Limit

Maximum Monthly Benefit

-Maximum Monthly Social Security Benefit at Full Retirement Age: $2,788

Retirement Age

-Full Retirement Age: 66

-Early Retirement Age: 62

Cost of Living

-Cost-of-Living Adjustment: 2.0%

Disability Substantial Gainful Activity

-Substantial Gainful Activity for Nonblind Disabled: $1,180

SSI Monthly Standard Payments

-SSI Monthly Federal Payment Standard for Individual: $750.00

-SSI Monthly Federal Payment Standard for Couple: $1,125

SSI Resource Limits

-Resource Limit for Individual: $2,000

-Resource Limit for Couple: $3,000

For details and to see this information in pdf format see: https://www.ssa.gov/policy/docs/quickfacts/prog_highlights/RatesLimits2018.pdf