Non-Married Opposite-Sex and Same Sex-Couples are Eligible for Spousal and Survivor Benefits

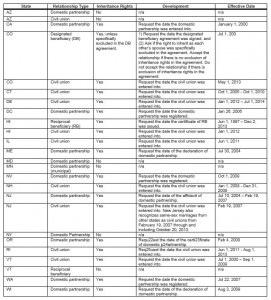

The Social Security Administration (SSA) in 2014 updated its rules about eligibility for both opposite-sex and same-sex spousal and survivor benefits for non-married couples. The SSA looks at each state to see if inheritance rights exist for the relationship, such as a domestic partnership or civil union. If the state recognizes the individual in the relationship and treats that person as a spouse when the other partner dies with no will in place, then the SSA will recognize that person as a spouse. This means that individuals in a domestic partnership or civil union may not have to get married to be entitled to Social Security spousal and survivor benefits. At the end of this post is an image of the SSA’s listing of states that recognize spousal inheritance rights. Click on this image for an enlarged view. For details see https://secure.ssa.gov/poms.nsf/lnx/0200210004.

The SSA provides the following two examples of how non-married same-sex applications for spousal benefits can be granted or denied.

Example for determining that the non-marital legal relationship is recognized for benefit purposes

Nicole, the “number holder” or worker and Penny (claimant) established a civil union in Colorado. Colorado appears in the chart below. In this section, which shows “Civil Unions” as a “Relationship Type.” Penny indicates that the relationship establishment date was after the “Effective Date” shown in the chart. Colorado’s civil union law would allow Nicole and Penny to inherit as each other’s spouse, according to the information under “Inheritance Rights” in the chart. When Penny applied for aged spouse benefits, Nicole was still domiciled in Colorado. The SSA will treat Penny and Nicole as spouses for purposes of determining entitlement.

Example for determining that the non-marital legal relationship is not recognized for benefit purposes

Tony, the “number holder” or worker and Tim (claimant) entered a domestic partnership in Rhode Island. Rhode Island appears on the chart below. In this section; however, the only type of relationship listed on the chart for Rhode Island is a “Civil Union.” Therefore the SSA will treat the claimant as unmarried for benefit purposes. Tony and Tim’s application will be denied.

Note: The Supreme Court’s June 2015 ruling states that married same-sex couples are eligible for Social Security benefits regardless of which state they reside. To be eligible for spousal benefits, the claimant must be continuously married for a least one year and currently married to the wage earner when the spousal benefit application is filed.

Click on this image to enlarge